Form W-9 is an IRS form used when a person or company pays your LLC for services.

It gives them the information they need to report payments to the IRS, including your:

- Taxpayer Identification Number (like your EIN or SSN)

- Business name

- Entity type

- Address

Form W-9 is usually requested when a US person (or US company) pays your LLC $600 or more in a calendar year for services.

(If you need to download Form W-9, use this link: IRS: About Form W-9)

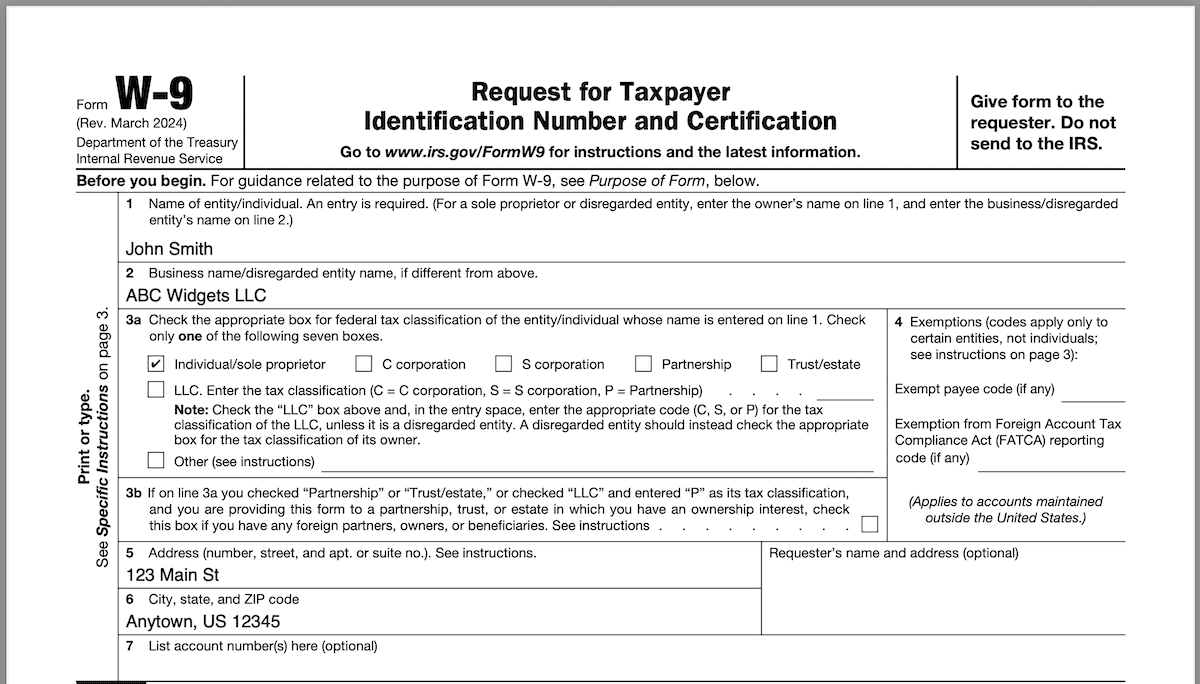

Below are instructions for how to complete W9 (form revised by IRS March 2024):

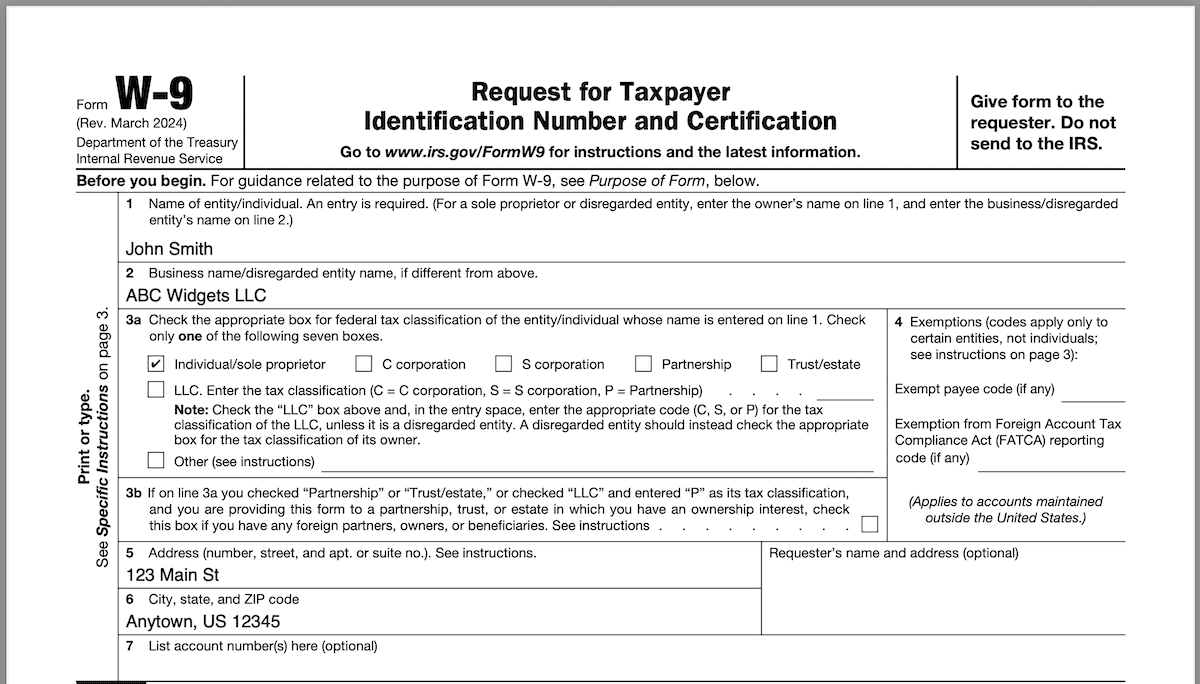

How to fill out W-9 for a Single-Member LLC (taxed as Sole Proprietorship)

Note: By default, all Single-Member LLCs are taxed like a Sole Proprietorship.

1. Name of entity/individual

Enter your own name.

Don’t enter the name of your LLC.

2. Business name/disregarded entity name, if different from above:

Enter your LLC’s name.

3a. Check the appropriate box for federal tax classification:

Check off “Individual/sole proprietor”

Don’t check off the “LLC” box.

3b. Foreign partners

Leave this blank.

It doesn’t apply to Single-Member LLCs.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Leave “Social Security Number” blank.

Pro Tip: I recommend listing your LLC’s EIN Number, and not your Social Security Number. This is for privacy and identity theft reasons. Many companies requesting Form W-9 don’t have robust security.

Part II – Certification

Sign your name. And date the form.

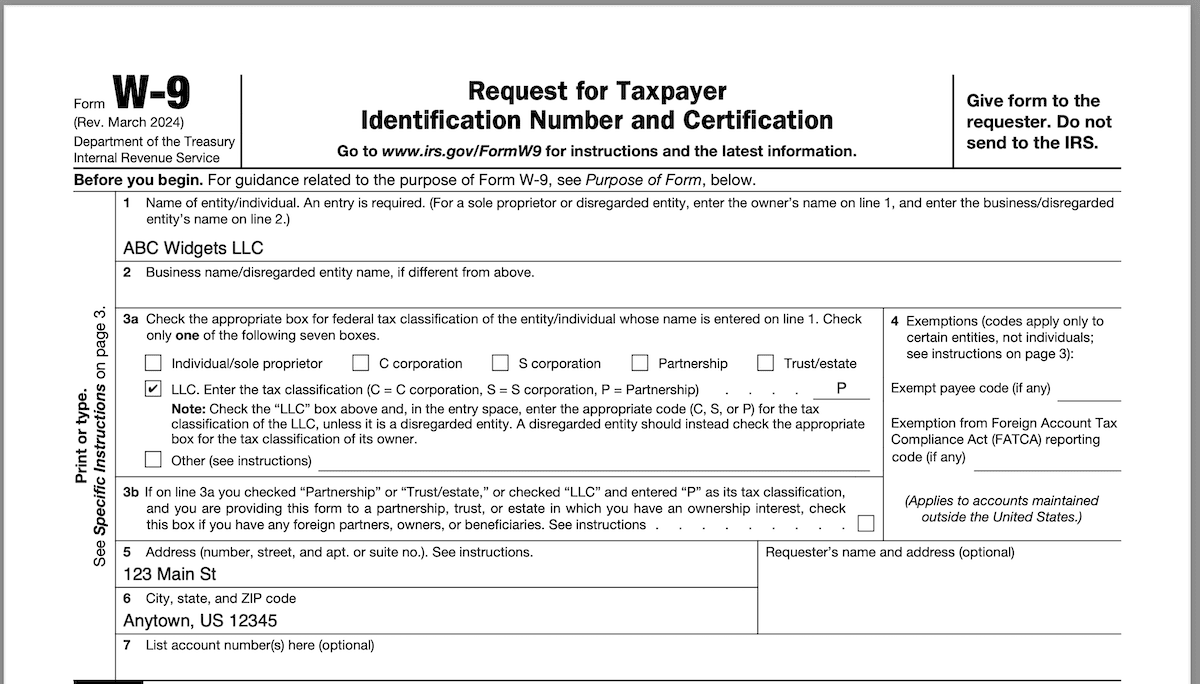

How to fill out W-9 for a Multi-Member LLC (taxed as Partnership)

Note: By default, all Multi-Member LLCs are taxed like a Partnership.

1. Name of entity/individual

Enter your LLC’s name.

Don’t enter your individual name.

2. Business name/disregarded entity name, if different from above:

Leave this blank.

This doesn’t apply to Multi-Member LLCs.

3a. Check the appropriate box for federal tax classification:

Check off the “LLC” box.

Then write “P” to the right.

3b. Foreign partners

Most people leave this blank.

Only check this box if all of the following apply:

- You selected “LLC” and entered “P” (for Partnership) as the tax classification.

- You are providing this W-9 to an LLC/Partnership that you own.

- There are foreign partners, owners, or beneficiaries associated with your LLC.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Part II – Certification

Sign your name. And date the form.

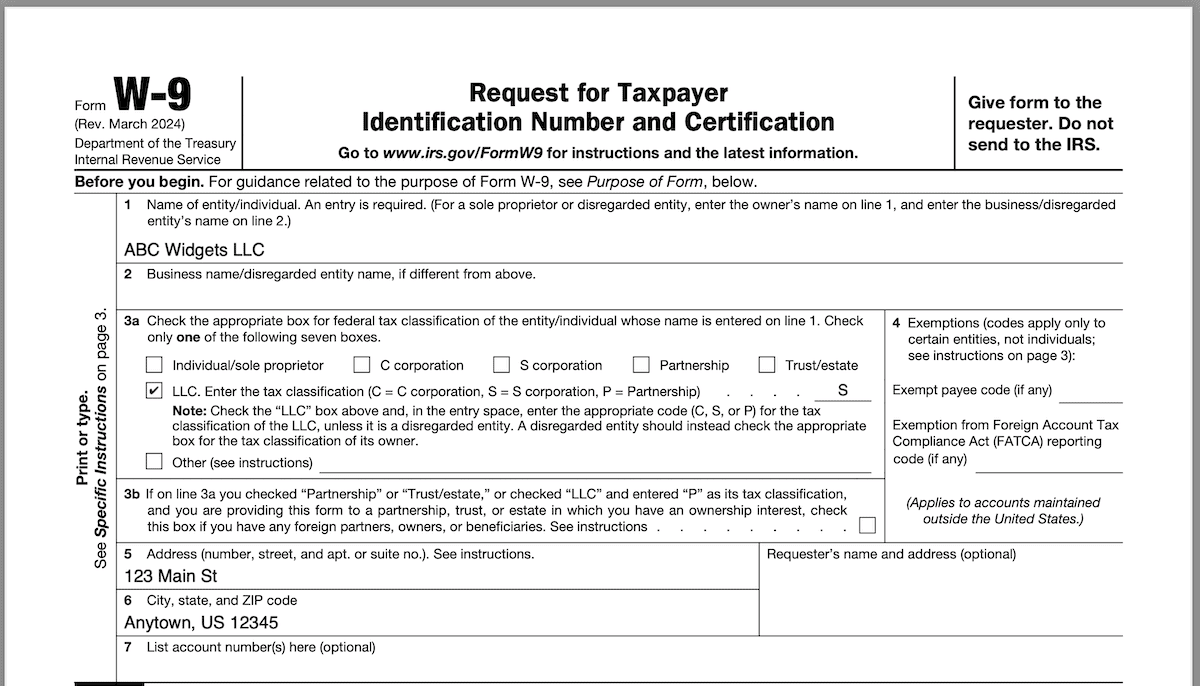

How to fill out W-9 for an LLC taxed as an S-Corp (Single-Member or Multi-Member)

Note: Instead of default tax elections, both Single-Member LLCs and Multi-Member LLCs can elect for an LLC taxed as an S-Corp.

1. Name of entity/individual

Enter your LLC’s name.

Don’t enter your individual name.

2. Business name/disregarded entity name, if different from above:

Leave this blank.

3a. Check the appropriate box for federal tax classification:

Check off the “LLC” box.

Then write “S” to the right.

3b. Foreign partners

Leave this blank.

This doesn’t apply to LLCs taxed as S-Corporations.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Part II – Certification

Sign your name. And date the form.

W-9 for an LLC taxed as an C-Corp (Single-Member or Multi-Member)

Note: Instead of default tax elections, both Single-Member LLCs and Multi-Member LLCs can elect for an LLC taxed as a C-Corp.

Fill the form out just as an LLC taxed as an S-Corporation would.

The only change is on 3a:

Check off the “LLC” box.

And then enter “C” to its right.

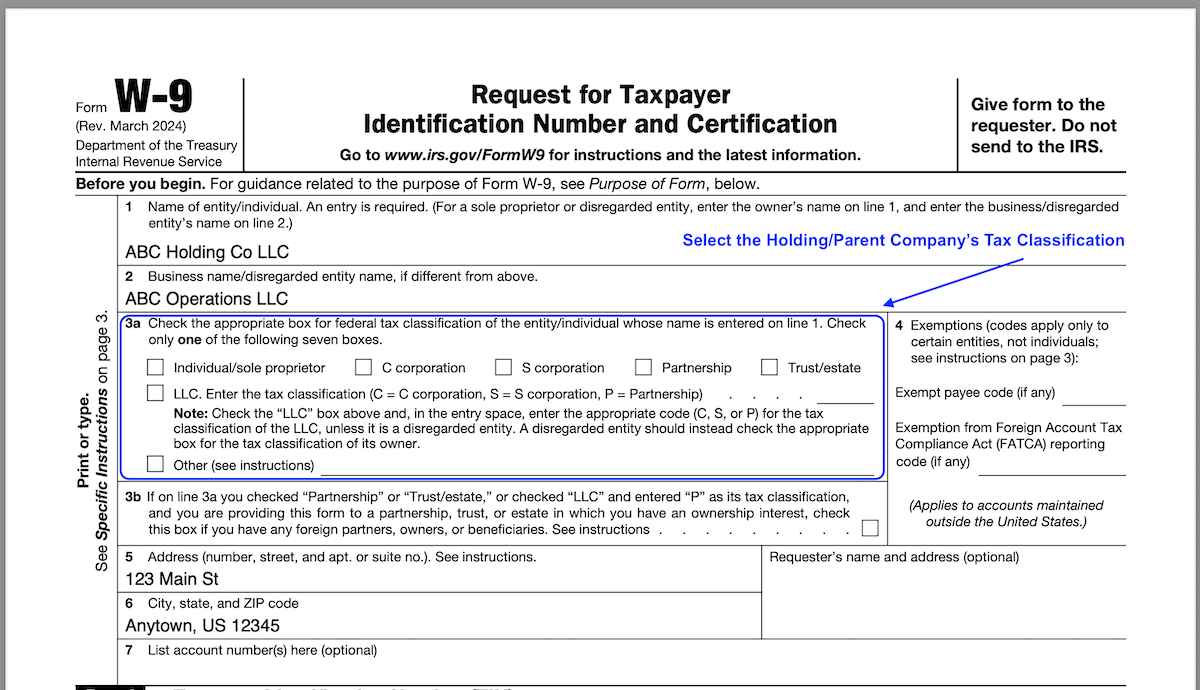

How to fill out W-9 for an LLC owned by another LLC

Note: An LLC can own another LLC. This is often referred to as a Holding Company LLC and Subsidiary LLC(s). Or as a Parent LLC and child LLC(s). They all mean the same thing.

In the example below, ABC Holding Co LLC is the Parent LLC, and ABC Operations LLC is the Child LLC.

1. Name of entity/individual

Enter the name of the Holding/Parent LLC.

Don’t enter the name of the Subsidiary/Child LLC.

Why? The Child LLC is a disregarded entity (aka an LLC with 1 owner). It doesn’t file its own return. It’s income/losses/credits/deductions all “flow up” to the Parent LLC. Said another way, the Parent LLC is the one that files the return.

2. Business name/disregarded entity name, if different from above:

Enter the name of the Subsidiary/Child LLC.

3a. Check the appropriate box for federal tax classification:

This will depend on how the Parent LLC is taxed.

However the Parent LLC is taxed, please reflect that in 3a.

(See other LLC examples above)

3b. Foreign partners

Most people leave this blank.

Only check this box if all of the following apply:

- Your Parent company is an LLC taxed as a Partnership.

- You are providing this W-9 to an LLC/Partnership that you own.

- There are foreign partners, owners, or beneficiaries associated with your LLC.

4. Exemptions

Leave this blank.

5, 6, and 7 – Address

Enter your LLC’s mailing address.

This address can be:

- your home address

- office address

- mailbox address

Part I – Taxpayer Identification Number (TIN)

Enter your LLC’s EIN Number.

Part II – Certification

Sign your name. And date the form.

Other examples

Husband and Wife Single-Member LLC

For a Husband and wife LLC (Qualified Joint Venture), complete the form as if you were a Single-Member LLC.

Note: Only one of the spouses names will be on line 1.

Any more examples you’re looking for?

Please make your request (include full details and context) in the comments below.

W9s for LLCs – Frequently Asked Questions

Does my LLC need to fill out a W-9 form?

Yes, if someone is paying your LLC and needs to report it to the IRS, they’ll ask you for a W-9.

This is super common if you’re doing freelance work, client services, or getting paid rent or commissions.

The W-9 gives them the info they need to send you a 1099 later.

What if my LLC is taxed as an S-Corp or C-Corp—do I still use the W-9?

Yes, you do.

Please see above for examples on both.

Do I need to give someone a W-9 if they paid my LLC less than $600?

Technically, no, you don’t.

The IRS only requires 1099 reporting for payments of $600 or more (for services, not goods), so if you’re under that amount, there’s no legal requirement to provide a W-9.

If a company persists and still wants one, it’s no harm in sending one though!

Should I use my SSN or my EIN on the W-9 for my LLC?

If you have a Single-Member LLC, you can use either one, but I recommend using your LLC’s EIN for privacy.

This helps protect your Social Security Number.

Can I send the same W-9 to multiple clients, or do I need a new one each time?

Yes, you can certainly reuse your W-9. There’s no rule that says you have to fill out a fresh one every time.

As long as your information hasn’t changed, it’s perfectly fine to send the same W-9 to anyone who asks.

Just make sure it’s signed and dated.

Do I need to submit the W-9 to the IRS?

No, you don’t send the W-9 to the IRS.

You send your W-9 to the person or company that asked for it. And in return, they use that information to issue your LLC a 1099.

Said another way, the IRS never sees your W-9 directly.

What happens if I don’t fill out a W-9 when someone asks?

If you ignore a W-9 request, the person or business paying you might have to withhold 24% of your payment and send it to the IRS. That’s called backup withholding. So instead of getting paid the full amount, you might get the amount, minus 24%.

Having said that, this isn’t all that common.

It’s still best to provide the W-9 to avoid any headaches later.

Should I use my personal name or my LLC name on the W-9?

It depends on your tax setup.

If you’re a Single-Member LLC (taxed as a Sole Proprietorship), put your name on Line 1 and your LLC name on Line 2.

If your LLC is taxed as a Partnership, S-Corp, or C-Corp, put your LLC name on Line 1. Line 2 will most often be left blank.

What tax classification do I enter for my LLC on Line 3a?

Single-Member LLC: Check “Individual/sole proprietor”

Multi-Member LLC: Check “LLC“, and then enter “P” (for Partnership) to the right.

LLC taxed as an S-Corp: Check “LLC“, and then enter “S” to the right.

LLC taxed as a C-Corp: Check “LLC“, and then enter “C” to the right.

Do I need to check the box on Line 3b of the W-9?

In almost all cases, no. Line 3b only applies if all of the following apply:

- You selected “LLC” and entered “P” (for Partnership) as the tax classification.

- You are providing this W-9 to an LLC/Partnership that you own.

- There are foreign partners, owners, or beneficiaries associated with your LLC.

What if I made a mistake on the W-9 I already sent?

It’s not a big deal. Just fill out a new one with the correct info and send it to whoever requested it.

There’s no penalty for correcting a W-9.

Tip: Always double-check your EIN Number before sending the form.

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.