Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Every Utah LLC needs to file an Annual Report each year to keep their business in good standing with the Utah Department of Commerce.

If you just started your Limited Liability Company, you won’t have to file this until next year (just bookmark this page for later).

If it’s time to file your Utah Annual Report now, this page will walk you through the filing instructions.

Important: If you don’t file your Utah Annual Report within 60 days of the due date, the state will shut down your LLC. This page will show you how to file your Annual Report, or what to do if it’s late.

What is an Annual Report for an LLC?

The Utah Annual Report is a filing that keeps your LLC’s contact information up to date with the Utah Division of Corporations.

Annual Reports in Utah can be filed online or by mail and they keep your LLC active.

Note: The Utah Annual Report may also be referred to as the Business Renewal or Annual Renewal. We will use these terms interchangeably.

Does Utah require Annual Renewals?

Yes. Utah requires every LLC (Limited Liability Company) to file Annual Reports every year.

How much does it cost to file a Utah Annual Report?

The Utah Annual Report costs $18 each year. This filing fee is paid every year for the life of your LLC.

Do I have to file an Annual Renewal for my LLC every year?

Yes, you have to file a Utah Annual Report (LLC Renewals) every year. It is a state requirement in order to keep your Utah LLC active and in good standing.

This is required regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file an Annual Report every year.

What do I need to file my Utah Annual Report?

In order to file your Annual Renewal, you’ll need your LLC’s Renewal Postcard.

Why do I need the Renewal Postcard? It has the following important information:

- Your LLC’s Entity ID Number

- The due date of your Annual Renewal

- Your Renewal ID Number, which lets you log into the online filing system

Where is the Renewal Postcard sent? The Utah Division of Corporations will send the Renewal Postcard (aka Renewal Notice) to your Utah Registered Agent.

Your Registered Agent should receive the Renewal Postcard 60 days before your Business Renewal is due. If you or a friend are your Registered Agent, keep an eye out for this piece of mail. If you hired a Registered Agent Service, they should scan or forward the Renewal Postcard to you.

What if I can’t find the Renewal Postcard? If you didn’t get the Renewal Postcard, or misplaced it, don’t worry. You can request the information from the Utah Division of Corporations.

Utah Annual Report Due Date

Utah Annual Reports are due by the last day of your LLC’s anniversary month.

Your LLC’s anniversary month is the month it was approved by the Utah Division of Corporations. You can find this date on your approved Certificate of Organization or by searching for your LLC on the Utah Business Entity Search. The due date is also printed on your Renewal Postcard.

For example, let’s say the Division of Corporations approved your LLC on March 12, 2024. So March 12 is your LLC anniversary date and March is your anniversary month. And your Annual Report would be due by March 31 every year after that.

When is my first Utah Annual Report due?

Your first Annual Report is due the year after your LLC was approved.

For example, let’s say your LLC was approved on March 12, 2024. Your first Annual Report is due by March 31, 2025. Then your Annual Reports are due by March 31 every year after that.

How early can I file my Annual Renewal?

You can file your Annual Report as soon as you receive your Renewal Postcard. This will be approximately 60 days before the due date.

(Remember, your Renewal Postcard will be mailed to your Utah Registered Agent.)

Grace Period

The state gives you a 30-day grace period to file your Annual Report late. Meaning, you can file your Annual Report up to 30 days late with no penalty and no late fee.

For example, if your Annual Report due date is March 31, your Grace Period is April 1 to April 30. As long as you file before April 30, there is no penalty and no late fee.

Delinquency Period

If you don’t file your Annual Report within the Grace Period, you have 30 more days to file your Annual Report late – but you’ll pay a late fee. This is called the Delinquency Period. During this period, your LLC is marked with a “Delinquent” status on the Utah Division of Corporations website.

If you file your Annual Report during this Delinquency Period, you will have to pay a $10 late fee ($28 total). There is no other penalty. Your LLC is renewed and ready to go.

If you don’t file your Annual Report by the end of the Delinquency Period, the state will dissolve (shut down) your LLC.

For example, if your due date is March 31, your Delinquency Period is May 1 to May 31. If you file between May 1 and May 31, you’ll need to pay the $10 late fee. If you don’t file by May 31, the state will dissolve your LLC and mark it as “Expired”.

Expired LLC

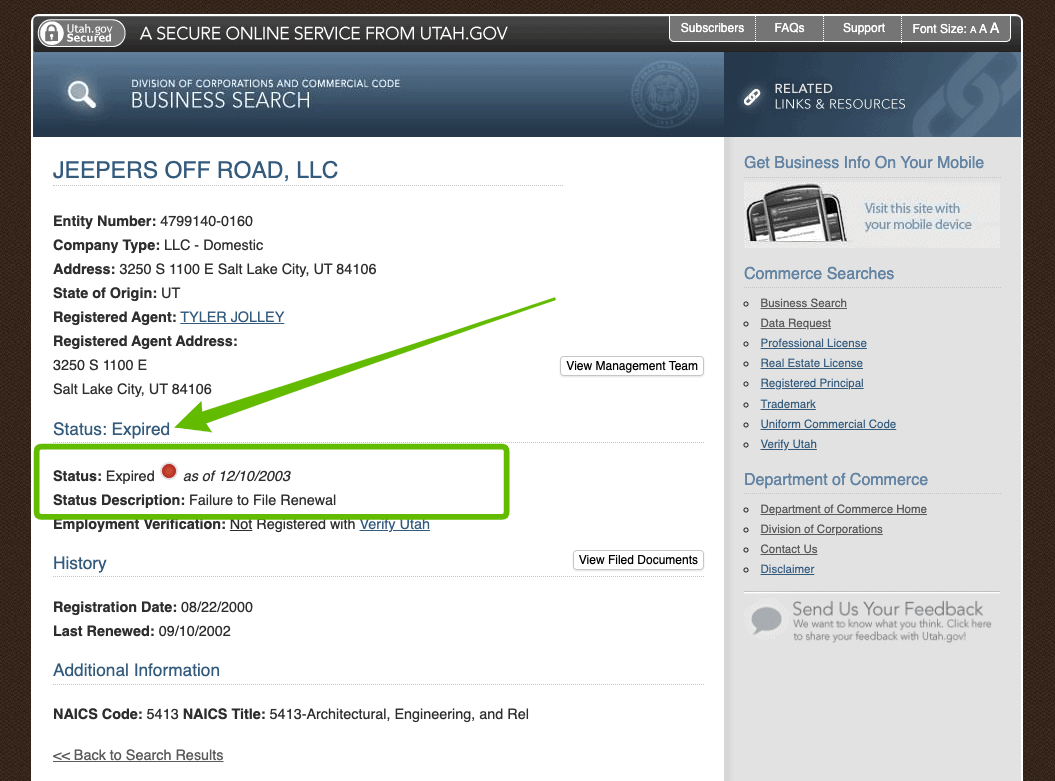

If you don’t file your Annual Report during the 30-day Grace Period or the 30-day Delinquency Period, the state will shut down your LLC. And then its status changes to “Expired”.

This means that the state cancels your business’s registration. And technically, you shouldn’t operate an Expired LLC. Instead, you need to Reinstate your LLC, which we explain below.

For example, if your due date was March 31 and you never filed your Annual Report, your LLC status would change to “Expired” 60 days later on June 1.

How do I know if my LLC is Expired?

The state will send an Expiration Notice to your LLC’s Principal Business Address, your Registered Agent, and to an LLC Member. You can also check the status of your LLC by using the Business Entity Search tool.

What should I do if my LLC Expires?

If you (and any other LLC Members) are ready to shut down your business, you can let your LLC Expire. There’s no penalty for doing this and you don’t need to file anything else with the Division of Corporations. You can then file a final tax return and close the LLC bank account.

If you want to keep using your LLC, you need to “bring it back to life” by filing a Reinstatement.

Reinstatement

If you need to file a Reinstatement, it will cost $54. You can file it online (see Online Business Reinstatement) or by mail (Application for Reinstatement).

You can only Reinstate your LLC within 2 years from the date your LLC was marked “Expired”. After 2 years have passed, you can’t file a Reinstatement. Instead, you must start over by forming a new Utah LLC.

For example, if your LLC Expired on July 1, 2024, you can file your Application for Reinstatement any time before July 1, 2026. To find the date your LLC Expired, you can use the Business Entity Search tool.

Tip: Make sure you still have a valid Registered Agent before Reinstating. If a friend or family member is the Registered Agent, confirm they’re still willing to do it. If you hired a Registered Agent Service, check that your subscription is still active.

How do I file my Annual Report in Utah?

You can file online or by mail. However, we recommend using the online filing method because you get an immediate confirmation of the filing. And you’re also able to update your Registered Agent, LLC Members, and business address online.

Things to have ready:

- LLC Entity Number

- Renewal ID Number

- Credit or debit card

Entity Number and Renewal ID Number

In order to access the online filing, you will need your LLC’s Entity Number and Renewal ID Number.

Both of these are printed on the Renewal Postcard (aka Renewal Notice) that is mailed to your Registered Agent.

If you don’t have that postcard, you can get these numbers by doing the following:

First, use the Utah Business Entity Search to find your LLC’s Entity Number.

Then either:

- use the Renewal ID Request Form to get your Renewal ID Number

- or call the Utah Secretary of State to ask for your Renewal ID Number.

Note: The Renewal ID Number is also called the “Access ID”.

Login to online filing

Get started:

- Go to the Utah Corporations Division Business Renewal page

- Login using your Entity Number and Renewal ID Number

After logging in, you’ll see all of your LLC’s info on the next page.

Review the information and make sure it’s up to date.

If you need to make any changes, there are “edit” links to the right of each section.

Note: If you don’t need to change anything, you can skip to the end and click the Click Here to Renew button to continue. You can jump to those instructions below.

Business Entity Details

The only thing you can edit in this section is your Principal Business Address.

A Principal Business Address is your LLC’s “location”. This must be a physical address (no PO boxes allowed).

This address can be a:

- home address

- office address

- mailbox rental address

- address of your Registered Agent (if allowed)

And this address can be a Utah address or an address in any other state.

If you need to change your Principal Business Address, click “Edit Address“.

If you don’t need to change this, go to the next section.

Registered Agent Information

- Prior lesson: You might find it helpful to read our Utah Registered Agent guide before updating your information.

Review your existing Registered Agent information.

If it’s all correct, you can go to the next section.

If you want to keep your existing Registered Agent, but change their address, click “Edit Address“.

If you want to change your Registered Agent, click “New“.

New Commercial Registered Agent

Is the Registered Agent a Commercial Registered Agent?

If you hired a Commercial Registered Agent (aka Registered Agent Service), click Yes.

Then select “Non-person entity“. Click “Look up the entity number” to find the company’s Entity Number.

Pro Tip: Most Commercial Registered Agents are listed twice in Utah’s records. Make sure to click the record that says “Commercial Registered Agent” in the “Type” column. Then write down their Entity Number.

Then go back to the other tab and enter the Entity Number.

Once you click Submit, this new Registered Agent’s name and address will replace the old one.

New individual person as Registered Agent

Is the Registered Agent a Commercial Registered Agent?

If your new Registered Agent will be a person (you, business partner, friend, or family member), click No.

Now select Person and enter their first and last name. Enter their Utah street address (not a PO Box).

Once you click Submit, this new Registered Agent will replace the old one.

NAICS Information – Business Purpose (optional)

An NAICS Code for an LLC is used by the state to identify your LLC’s line of business and activities. It’s mostly used for statistical purposes and you aren’t forced to do this activity forever.

Utah doesn’t require you to enter an NAICS Code, so you can leave this blank if you want.

If you have an NAICS Code and want to edit it (or you want to add one), click “Edit“. Then select from the series of dropdown menus.

Registered Principals/Officers

The existing Principals – LLC Member(s) and/or Manager(s) – will be listed here.

Note: If there are no Principals listed, you must add at least one.

Editing

If you need to edit a Principal’s address, click “Edit Address“.

The address can be in any state, or any country.

Note: The link to “Copy to Another Position” isn’t very useful or commonly used. Don’t click this.

Adding

To add a Principal, click “Add Principal/Officer“. Then select “Person” on the next page and enter their name.

Select the appropriate title from the dropdown for Position:

- If the person is an LLC Member, select Member.

- If the person is an LLC Manager, select Manager.

Pro Tip: You can ignore the title “Governing Person”. It’s better to list a Principal as either a Member or Manager. If these terms are confusing or unfamiliar, check out Member-managed vs Manager-managed LLC.

Enter the person’s address. This can be in any state or any country.

Removing

If you need to remove a Principal, click Remove.

Remember: Your LLC Renewal must have at least one Principal listed. If you remove all the Principals, you’ll need to add at least one before you can file the Business Renewal.

Submit the Filing

When you’re finished reviewing and making changes, you can click the button “Click Here to Renew”.

Verification

Review the information from your LLC Renewal to ensure everything is correct. Go back to fix any typos, if needed.

If everything looks good, you can sign the renewal form. Simply type your name and click Submit Signature.

Payment

Next, submit the $18 filing fee using a debit card or credit card.

Enter an email address if you’d like to receive a payment receipt.

And make sure you click to confirm the payment information and submit the payment.

Congratulations

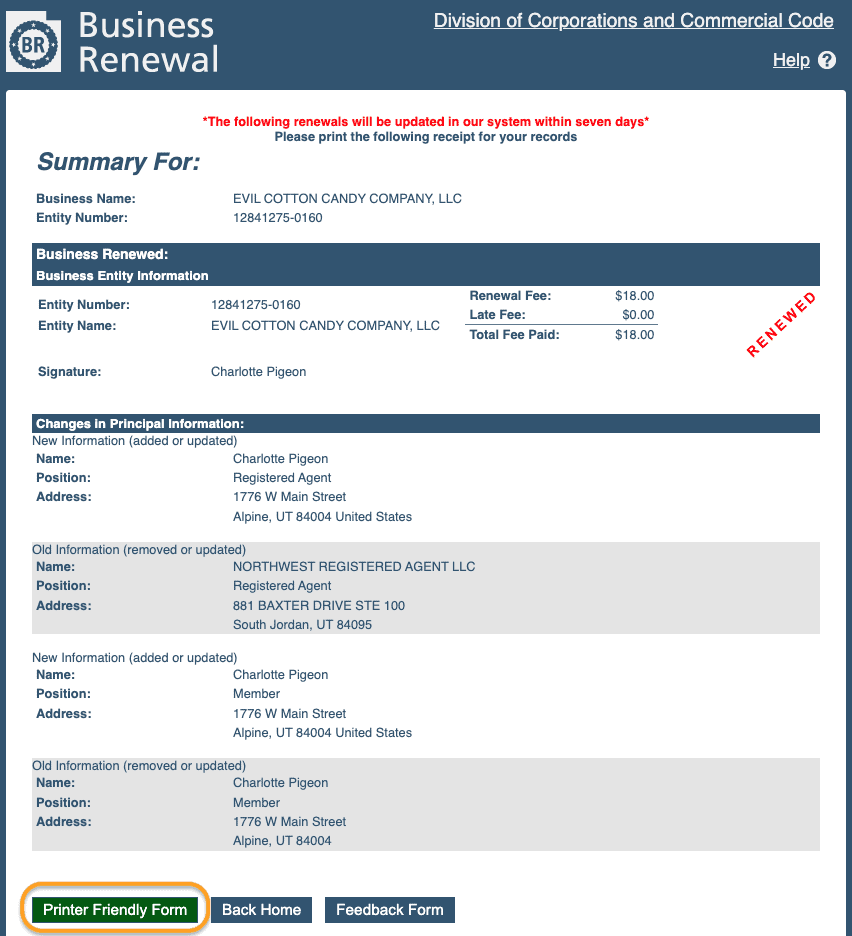

Your Utah Annual Report was filed online and will be processed within a few minutes.

Before closing this window, download or print a copy of the filed Annual Report. (The state doesn’t email you a copy of the filing).

Click the link for a Printer Friendly Form to save a PDF or print your Annual Report filing. And keep a copy with your business records.

Set a calendar reminder to file your Annual Report every year

To make sure you file your Annual Report on time (and so you don’t have to worry about late fees or filing a Reinstatement), we recommend putting a repeating reminder on your phone, computer, and/or calendar.

Here’s a video on how to use Google Calendar to create reminders for Annual Reports:

Utah Department of Commerce: Division of Corporations Contact Info

If you have any questions about your LLC Annual Report, you can contact the Division of Corporations and Commercial Code within the Utah Department of Commerce.

Their phone number is 801-530-4849. Their hours are Monday through Friday, from 8am to 5pm Mountain Time.

Utah Annual Report Filing FAQs

What is a Renewal for an LLC?

The Annual Business Renewal is the same thing as the LLC Annual Report in Utah.

It’s the filing that is due every year in order to keep your LLC active.

You can do this yourself, or you can hire somebody to file the Utah Business Renewal for an LLC. Most LLC Filing Companies offer a Utah Annual Report Service in their packages.

How much does it cost to renew an LLC in Utah?

The filing fee for an Annual Business Renewal in Utah is $18 per year.

If you file your LLC Renewal online, you can pay by credit or debit card.

If you file your LLC Renewal by mail, make your check payable to the “State of Utah”.

How often do you have to renew your LLC in Utah?

Every year.

In Utah, some business entities (including LLCs) must file Annual Reports every year. If you fail to renew your LLC, it will “Expire” and you’ll then have to Reinstate it or file a new LLC altogether.

If you don’t want to go through the Annual Report filing process every year, you can hire an Annual Report service. Most LLC Filing Companies and Registered Agent Services offer a Utah Annual Report Service in their packages.

What happens when an LLC expires in Utah?

If your LLC expires, this is the same as an administrative dissolution where the state shuts down your LLC (or cancels your business registration).

If your LLC expires, you have 2 years to Reinstate it. If you fail to Reinstate the LLC within that 2 years, you must form a new LLC by filing another Certificate of Organization.

How to Reinstate an LLC: Follow the instructions on the Division of Corporations page: Reinstate your LLC. You will file the Reinstatement online and pay $54 in filing fees.

How to start a new LLC: If it’s been more than 2 years since your LLC expired, you must form a new Utah LLC. The filing fees for new LLCs are $54.

What is the processing time for a Utah Annual Report?

If you file online, it’s processed immediately.

If you file by mail, it may take up to two weeks with mail time.

Will I be charged a late fee if I don’t file a Utah Annual Report on time?

If you file within the 30-day Grace Period after the Report due date, there is no late fee.

However, there is a late fee if you file after the 30-day Grace Period. This is called the Delinquency Period and it lasts for an additional 30 days. The late fee to file during the Delinquency Period is $10, so your total Annual Report filing fees are $28.

Note: If you don’t file an Annual Report within 60 days of the Annual Report deadline, you will have to pay $54 to Reinstate your LLC.

What is an LLC Expiration Date?

Because Utah law requires an LLC to be “renewed” every year, you will see mention of an “expiration date”. In Utah, your LLC will “expire” unless you renew it.

Your LLC’s anniversary date is the date it was approved by the Division of Corporations. Your LLC’s Annual Report is due by the last day of your anniversary month (not the exact anniversary date). This due date is sometimes called the expiration date, because unless you Renew the LLC, it “expires”.

The actual change of status to Expired doesn’t happen until 60 days after the expiration date (the due date of the Annual Report). The Division of Corporations calls that the “Date of Status Change”.

Can I file my Utah Annual Report by mail?

Yes, you can file the Renewal Application by mail (instead of online).

First, download the Annual Report/Renewal Form.

Enter:

- Your LLC’s Entity Number (find it using the Business Entity Search tool)

- Entity type: Enter “Domestic Limited Liability Company“

- Expiration Date: Last day of your LLC’s anniversary month (written in MM/DD/YYYY format)

- Entity Name: Enter your LLC name (including “LLC” or other designator)

Prepare a check payable to the “State of Utah” for the $18 filing fee. Mail to the Division of Corporations at PO Box 146705, Salt Lake City, UT 84114.

Note: If you need to make changes to your LLC’s Registered Agent, Primary Business Address, or the names of your LLC Members or Managers, you will also need to complete a Registration Information Change Form (download it here). There’s no additional charge to file this form with your Annual Report.

Can I file my Annual Report online if I filed my LLC by mail?

Yes.

Even if you didn’t file your LLC online, your Registered Agent will get a postcard that provides the Renewal ID Number. That’s the number you need to file your LLC Renewal using the online system.

If you don’t know your LLC’s Entity Number, you can find it with a simple (and free) search on the Business Entity Search page.

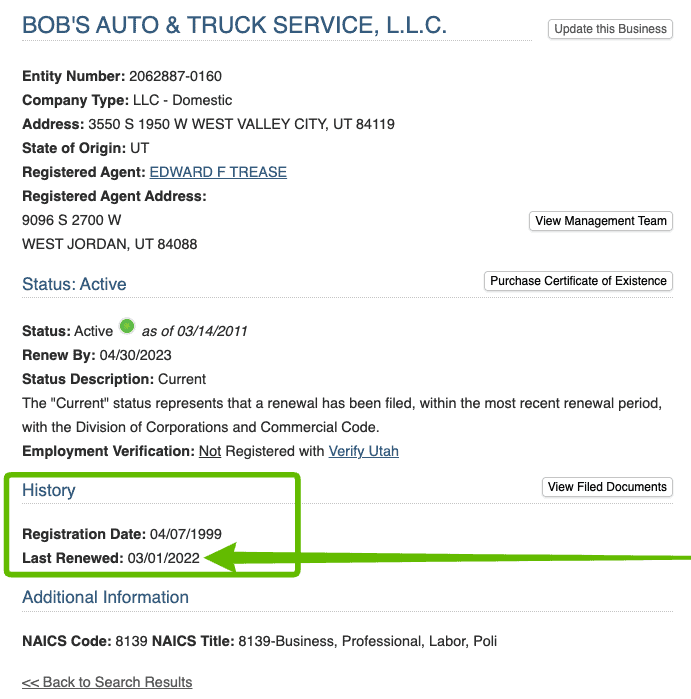

How do I get a copy of my filed Annual Report?

If you forgot to download a copy of the Annual Report on the success screen, unfortunately you cannot get another copy.

But, you can confirm that your Report was filed by searching for your LLC in the Business Entity Search. It takes 7-10 business days for your Report filing to become available in the system after you submit it online.

As after 7-10 business days have passed, search your LLC using the Business Entity Search page. Look for the History section and check the “Last Renewed” date to confirm the most recent filing date.

References

Utah LLC Act: Section 48-3a-212

Utah LLC Act: Section 48-3a-102

Utah Business Renewal: Instructions

Utah Business Renewal Online Filing

Utah Division of Corporations: Renewal Process

Utah Division of Corporations: About the Postcards

Utah Division of Corporations: How to Reinstate a Business

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Leave a comment or questionComments are temporarily disabled.