Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report).

Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report).

However, as of 2025, every Pennsylvania LLC is now required to file a report every year instead.

And this filing is called an Annual Report.

What is an Annual Report for an LLC?

The Pennsylvania Annual Report is a filing that keeps your LLC’s contact information up to date with the Department of State.

It can be filed online or by mail, and it keeps your LLC in compliance and in good standing.

Does Pennsylvania require an Annual Report?

Yes. As of 2025, every Pennsylvania LLC (Limited Liability Company) must file an Annual Report every year. It is a state requirement in order to keep your LLC in good standing.

All LLCs are required to file the Annual Report every year regardless of business activity or income. Meaning, even if your LLC does nothing and makes no money, you still have to file this paperwork every year.

How much does it cost to file an Annual Report in Pennsylvania?

The Pennsylvania Annual Report costs $7 per year.

This filing fee is paid every year for the life of your LLC.

Pennsylvania LLC Annual Report due date

All Pennsylvania Limited Liability Company (LLC) reports are due by September 30th every year.

When is my first Annual Report due?

Your first Annual Report is due the year after your LLC is approved.

For example:

- If your LLC is approved in 2024, then your first is due by September 30th, 2025.

- If your LLC is approved in 2025, then your first is due by September 30th, 2026.

Then your Annual Report is due by September 30 every year after that.

How early can I file my Annual Report?

You can file your LLC Annual Report as soon as January 1st of the filing year.

For example: If your LLC is due in 2026, you can file your Annual Report as soon as January 1st, 2026.

What happens if I don’t file my Annual Report?

Since this filing requirement is so new, the state won’t penalize you if you don’t file your Annual Report for the 2025 and 2026 filing years.

That said, the state will start applying penalties and fees beginning in 2027.

Annual Report Penalties (starting in 2027)

Beginning in 2027, your Pennsylvania Annual Report will be late if not filed by September 30.

If you’re late, the state will give you a 6-month window to file late.

If you don’t file within the 6-month window, the Department of State’s office will shut down your LLC. This is called administrative dissolution.

While an LLC is administratively dissolved, the business name can be taken by another business.

What should I do if my LLC is administratively dissolved?

If you want to shut down your LLC, you can just let the state close your LLC for you.

There’s no penalty for doing this and you don’t need to file anything else with the Department of State to dissolve your LLC. You can then file a final tax return to complete the closure of your LLC.

If you want to keep using your LLC, you need to “bring it back to life” by filing an Application for Reinstatement and paying the filing fee ($35 online).

You must also pay a $15 late fee for each of the Annual Report filings you missed.

Note: You can Reinstate your LLC anytime after it’s been dissolved. However, if someone has taken your business name while your LLC has been dissolved, they get to keep it. And you’ll have to pick a new name for your business.

How to file a Pennsylvania Annual Report online

To file your Pennsylvania LLC Annual Report online, you need to create a Keystone Login.

If you already have a Keystone Login simply login.

Create a Keystone Login

If you don’t have a Keystone Login, visit PA Business One-Stop Hub and click “Register”.

Enter your registration information to create an account.

After registering, you’ll see a success message and you may need to verify your email.

Once you have a Keystone account, login.

Next, the system will ask you some questions, like the purpose of your visit and basic business information.

Choose the purpose of your visit

Click “Business Owner“.

Business Profile

You’ll see a Business Profile Page, but this step is unnecessary.

Click “Skip to Dashboard” to start your filing.

Get Started

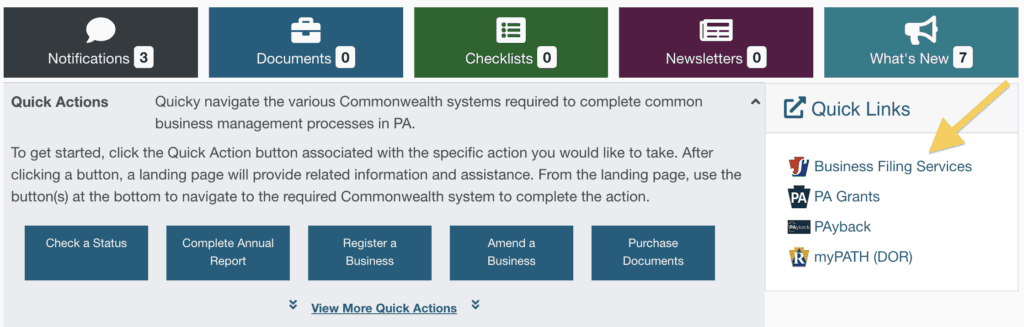

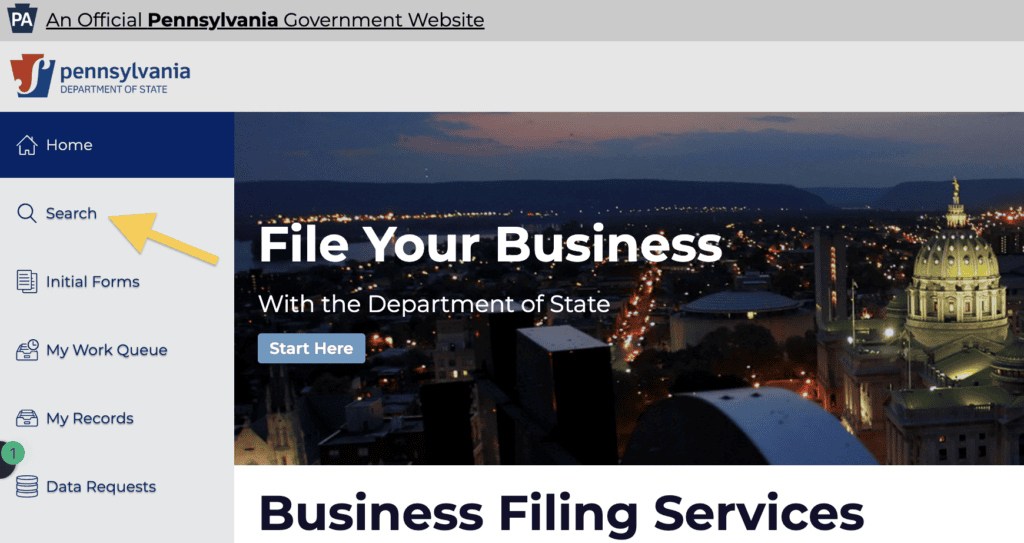

In your One-Stop Dashboard, click “Business Filing Services” on the right.

Then click on “Search” in the left-hand navigation menu. This will redirect you to the Business Search page.

Enter your LLC’s name and click the search icon.

Click on your LLC name in the search results, and then click “File Annual Report” in the pop-out menu.

Business Details

Scroll down to the Email Address section.

We recommend opting into the email notifications from the PA Department of State to receive your Annual Report reminders by email instead of regular mail.

To opt-in to email notifications:

- Select “I would like to receive email notifications from the Department of State…“.

- Click “Add“.

- Enter your email address.

- Click “Save“.

To continue receiving mail notifications, select “I would like to continue to receive by mail all notifications from the Department of State…“.

Then click “Next Step“.

Registered Office

If you want to change your Registered Agent address (aka Registered Office), you can do that here in the Annual Report filing.

The Registered Agent must have a physical address in Pennsylvania.

If you want to change your Registered Agent Office:

Select “I want to change the registered office“.

If your Registered Agent is you, a friend, or family member:

- Select “The address of this association’s proposed registered office in this Commonwealth is“.

- Enter your Registered Agent’s address and county.

Then click “Next Step“.

If you’re using a Registered Agent Service (aka a Commercial Registered Office Provider, like Northwest Registered Agent), select:

- Select “The name of the commercial registered office provider and the county of venue is“.

- Enter your Registered Agent’s name and click “Search“.

- Select your Registered Agent’s name from the search results.

- Enter the county where their address is located.

Then click “Next Step“.

If you don’t want to change your Registered Agent Office:

Select “I do not want to change the registered office“.

Then click “Next Step“.

Principal Office

Make sure your LLC’s Principal Office address is correct and up-to-date.

If it’s not, please update the address and country here.

Then click “Next Step“.

What is the Principal Office?

The Principal Office is the address where business activities take place and/or where business documents are kept for your LLC.

This address must be a physical street address. It can’t be a PO Box address.

The Principal Office address can be:

- a home address,

- an office address,

- or the address of your Registered Agent (if they allow it).

Governor(s)

You must have at least one governor on file.

The governor can be a person or an entity.

If you already have at least one governor on file, you can click “Next Step“.

To add a governor, click “Add“.

If the governor is a person:

- Enter their first and last name, and click “Save“.

- Then click “Next Step“.

If the governor is an organization:

- Check the box for “This entity is an organization“.

- Enter the name of the organization and click “Save“.

- Then click “Next Step“.

Principal Officer(s)

The Principal Officers section doesn’t apply to PA LLCs. This section is for Corporations.

Just skip this and click “Next Step”.

Processing Fee Information

There’s nothing to do here.

The system is just letting you know that the Annual Report filing fee is $7, and that you can check on the status of your filing through your One-Stop Dashboard.

Click “Next Step”.

Confirm

Review your filing for accuracy and check for any typos.

If you need to make any changes, click “Previous Step“, or click on a section in the left-hand navigation menu.

When everything looks good, click “Next Step“.

Sign and File Document

Agree to the terms and sign the document.

- Signer’s Capacity: Enter “Authorized Signer“.

- Signature: Enter your first and last name.

- Date: Click “Today” to enter today’s date.

File Online

Next, select whether you will file online or print and mail your filing.

We recommend filing online. If you prefer to file by mail, click “Print and Mail” and follow the online instructions.

Click “File Online“.

A blue payment menu will pop-out from the right. Click “Pay with credit or debit card“.

Payment Details

Enter your payment details, check the Captcha, and click “Pay with your Credit Card” to submit your filing to the state.

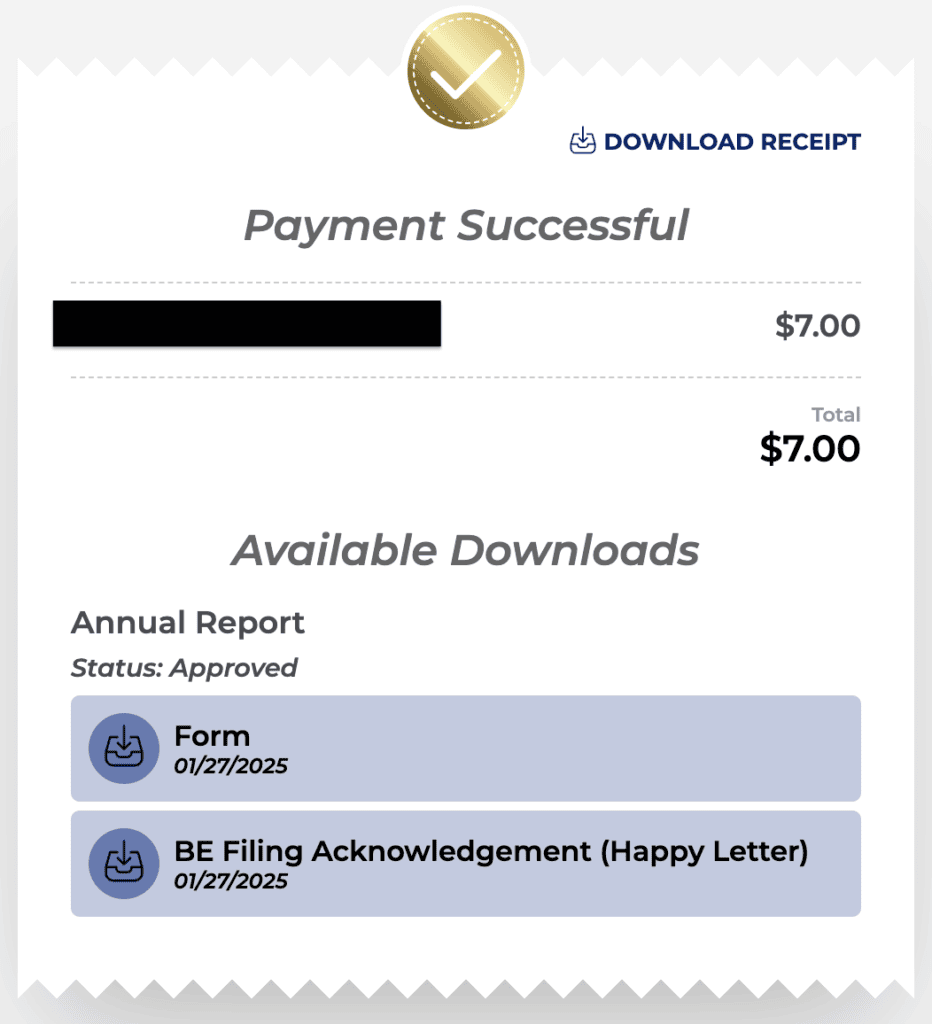

Approval

Congratulations, you’ve successfully filed your Pennsylvania LLC Annual Report!

You should see a success screen letting you know that your Annual Report has been immediately approved.

You can download a copy of your payment confirmation by clicking “Download Receipt“.

And you can download a copy of your approved Annual Report by clicking “Form“.

Pennsylvania LLC Annual Report Reminders

By default, reminder postcards will be mailed to your Registered Office (aka Registered Agent’s address) 2 months before the deadline. They are generally mailed out the first week of August.

Additionally, the PA Department of State allows you to opt-in to email reminders instead. You can sign up for email reminders in your Annual Report filing.

That said, even if you don’t receive a reminder of any kind, you are still responsible for filing the Annual Report on time.

So we recommend putting a repeating reminder on your phone, computer, and/or calendar just in case.

Here’s a video on how to use Google Calendar to create reminders:

Note: If you want help filing your paperwork, you can hire a company that offers Annual Report service. Check out our review of the best LLC services for our recommendations.

Pennsylvania Department of State, Bureau of Corporations Contact Info

If you have any questions, you can contact the Bureau of Corporations at the Pennsylvania Department of State.

Their phone number is 717-787-1057. And their hours are Monday through Friday, 8am to 5pm Eastern Time.

Pennsylvania Annual Report Filing FAQs

Do I need to file an Annual Report for my LLC in Pennsylvania?

Yes. As of 2025, every Pennsylvania LLC must file an Annual Report. This requirement begins the year after you start your LLC, and continues every year for the life of your LLC.

You can set up Google Calendar reminders to help remind yourself.

How much does it cost to file an Annual Report in Pennsylvania?

The Pennsylvania Annual Report for LLCs costs $7 per year. This is paid every year for the life of your LLC.

How do I file my Annual Report in Pennsylvania?

You can file your Pennsylvania LLC Annual Report form online or by mail.

We recommend filing online because it’s faster and easier.

Follow our step-by-step instructions above to file your Annual Report online.

What is the processing time for a Pennsylvania Annual Report?

The Pennsylvania Annual Report is processed and approved immediately when you file online.

Once you’ve filed your Annual Report online, you’ll immediately receive a success message and be able to download a copy of your filed Annual Report.

Will I be charged a late fee if I don’t file a Pennsylvania Annual Report?

The PA Department of State isn’t charging late fees or applying any other penalties for late or missed Annual Reports until 2027.

Since the Pennsylvania Annual Report is a new requirement, the state is being lenient on LLCs for the 2025 and 2026 filing years.

However, beginning in 2027, if you don’t file your LLCs Annual Report within 6 months of the filing deadline, the state will administratively dissolve (shut down) your LLC.

If that happens, you can restore your LLC by filing an Application for Reinstatement online ($35). You’ll also have to pay a $15 late fee for each Annual Report that you’ve missed.

How to get a copy of a Pennsylvania LLC Annual Report

Most people don’t need a copy of their Annual Report. This is because you can just look up your LLC on the state’s records to confirm that your Annual Report has been filed.

However, you can download a copy of your Annual Report from the success screen right after you file your Annual Report online..

Or, you can download a copy in your PA One-Stop account:

- Go to the One-Stop login page.

- Login with your Keystone Login.

- Click “Business Filing Services“.

- Then click “My Work Queue” in the left-hand navigation menu.

- Click on your Annual Report and click on the document labeled “Form” to download a copy of your report.

Can I file Pennsylvania LLC Annual Reports by mail?

Yes, you can file a PA LLC Annual Report by mail.

If you file an Annual Report by mail, the fee is $7 and the state will process it when they receive it in the mail.

That said, we recommend that you file online because it’s faster, easier, and it’s processed immediately.

References

PA Department of State: Business Filing Services

PA Department of State: Annual Reports in Pennsylvania

PA Department of State: New PA Business Annual Reports

PA Department of State: Filing an Annual Report Help Guide

Departmento de Estado de PA: Informacion de Reportes Anuales en Español

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Pennsylvania LLC Guide

Looking for an overview? See Pennsylvania LLC

Is an Annual report the same thing as an annual registration?

As a LLC, not a PLLC am I REQUIRED to file an Annual registration?

Hi Erin, in PA, a Certificate of Annual Registration refers to PLLCs. And Annual Report refers to regular LLCs. As of 2025, regular LLCs in PA need to file an Annual Report every year. Hope that helps.