Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Jump right to the instructions ⇓

Montana LLCs must file an Annual Report each year

Every LLC in Montana must file an Annual Report each year. This is due regardless of business activity or income.

Every LLC in Montana must file an Annual Report each year. This is due regardless of business activity or income.

Said another way, even if your LLC does nothing and makes no money, it’s still required file an Annual Report each year.

You need to file the LLC Annual Report with the Montana Secretary of State.

The Annual Report keeps your LLC in compliance and in good standing with the state.

How to file your Montana LLC Annual Report

The only method of filing your Montana LLC Annual Report is online.

The state stopped accepting mail filings back in 2017.

Montana LLC Annual Report Filing Fee

Good news: In 2025, if you file your LLC by the April 15th deadline, the Montana Secretary of State will waive your Annual Report filing fee. Said another way, it’s free ($0) to file your Montana Annual Report if you file before April 15th, 2025.

The Annual Report filing fee is $20 per year. This is paid once every year for the life of your LLC.

Annual Report Processing/Approval Time

Your Montana LLC Annual Report is processed instantly after you submit the filing online.

Annual Report Due Date

Your Montana LLC Annual Report must be filed before April 15th every year.

How early can the Annual Report be filed?

You can file your LLC Annual Report as early as January 1st in the year in which it’s due.

Penalty for not filing Montana Annual Report

If you miss the April 15th deadline, you will be charged a $15 late fee (on top of the $20 filing fee). So the total fee will be $35.

If you still don’t file by September 1st, the state will mail you a warning notice that your LLC is about to be dissolved (shut down).

If you continue to ignore this requirement, and you do not file your LLC Annual Report by December 1st, the state will administratively dissolve your Montana LLC.

Reinstatement – Not as scary as it seems

In reality, dissolution sounds scarier than it actually is. After a Montana LLC is dissolved, it can be reinstated (brought back to life) any time within 5 years of dissolution.

In order to reinstate a Montana LLC, a $35 reinstatement fee must be paid in addition to filing all past-due Annual Reports.

For more information, please see: MT Secretary of State: Reinstate a Business.

Annual Report Reminders

All Montana LLC Annual Report reminders are sent by email.

The state used to mail out postcard reminders, however, that is no longer the case as the Montana Secretary of State has been digitizing most of their processes.

Email reminders are sent out every 2 weeks between January and April 15 until your Annual Report is filed.

- If an email address was listed for the Registered Agent during your Articles of Organization filing, the email reminders get sent there.

- If an email address was listed for any Principal during your Articles of Organization filing, the email reminders also get sent there.

The #1 reason Montana LLCs are shut down

The #1 reason that LLCs are shut down by the Montana Secretary of State is for failure to file an Annual Report.

Even if you don’t receive the reminder notice that the state emails, it is still your responsibility to file your Montana LLC Annual Report on time every year.

For this reason, we strongly recommend putting a repeating reminder on your phone and your computer. Additionally, you can write out the due date and put it in some place where you’ll see it often.

Montana LLC Annual Report Instructions

What happened to Montana ePass? In 2022, Montana changed their systems. Now they use SOS Enterprise Online Filing instead of ePass.

If you have an ePass login, you’ll need to convert that to the new SOS Enterprise Account. In order to do that, click Reset Password on the Login screen and enter your old ePass username. When you get the password reset email, follow the instructions. This will create the SOS Enterprise Account from your existing ePass account.

Get started:

- Visit the Montana Secretary of State Business Services page. Click Filing Portal Login in the upper right corner and login. If you don’t have an account, you’ll need to create one.

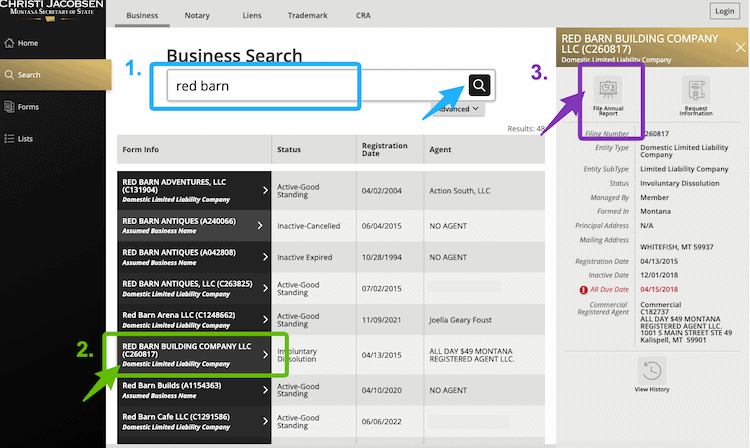

- Click “Search” in the left menu.

- Search for your LLC by name.

- Click on your LLC name in the results below.

- Click “File Annual Report” in the pop-out menu to begin your filing.

Note: If you don’t see the “File My Annual Report” button, you can call the Secretary of State (contact info is at the bottom of this page) to find out why it’s not working. There might be an issue connecting your account to your LLC record.

Filing Information

There is nothing to do in this step. The state is providing basic information about Annual Reports for different types of businesses.

Just click “Next Step“.

Entity Details

There is nothing to do in this step. Your LLC’s information is already entered here.

Just click “Next Step“.

Entity Addresses

In this step, the state is asking for the mailing address, and physical address for your LLC’s Principal Office.

What is a Principal Office? A Principal Office is where the primary business activities take place and/or where your LLC records are kept.

Business Mailing Address of Principal Office:

The state requires all LLCs to list a mailing address for their Principal Office.

Review your LLC’s Mailing Address. Leave it as-is if it’s up to date, or make edits if needed.

The Principal Office Mailing Address can be located in Montana, or in any state.

It can also be:

- a home address

- an office address

- a mailbox rental address

- a virtual office address

- the address of your Montana Registered Agent (if your Registered Agent allows it)

If you hired Northwest Registered Agent, they allow you to use their address for your LLC’s Principal Office Address.

Then click “Next Step”.

Business Physical Address of Principal Office:

Review your LLC’s Physical Address information. Leave it as-is if it’s up to date or make edits if needed.

That said, you can leave this section blank if you’d like. You aren’t required to list a Physical Address for your Principal Office in Montana.

Click “Next Step“.

Registered Agent in MT

In this section, you’ll either confirm your Montana Registered Agent hasn’t changed, or you can change your Registered Agent.

If you need to make changes to your Registered Agent, you can only appoint a new Registered Agent in your Annual Report.

Meaning, you can’t update your existing Registered Agent’s name or address in your Annual Report.

Note: If you are keeping the same person or company as your Registered Agent but need to change their address, you’ll need to file a Statement of Change of Registered Agent separately.

To keep your current Registered Agent:

You can just click “Next Step”.

How to change your Registered Agent

Check the box next to “Appoint a new registered agent” if there is a new person or company who will be your LLC’s Registered Agent.

If you hired a Commercial Registered Agent:

- Search for their company name in the Registered Agent box.

- Select their name from the list.

Note: If you want to use a Commercial Registered Agent, you need to hire them first before adding them here.

If you, a friend, or family member will be your LLC’s Registered Agent:

- Click “Add New Agent“.

- Select “Individual“.

- Enter their name, email, Montana street address, and mailing address.

- Click “Save“.

Check the box at the bottom (it says that the person you listed as your LLC’s Registered Agent has agreed to be the Registered Agent).

Then click “Next Step”.

Principals

Select whether your LLC is Member-managed or Manager-managed.

The state requires you to list the name and address of at least 1 LLC Member or LLC Manager (depending on how your LLC is managed).

If you already have at least 1 LLC Member or Manager listed, and their information is up-to-date:

- You can just click “Next Step”.

If you need to add a Member or Manager:

- Click “Add”.

- Select whether they are an Individual, a Registered Business Entity, or a Non-registered Organization.

- Enter their name, address, and email address.

- Click “Save”.

Then click “Next Step”.

Note: To learn more about LLC Members and LLC Managers, please see Member-managed vs Manager-managed LLC.

Review

Review your filing for accuracy and check for any typos.

If you need to make any changes, click “Previous Step”, or click on a section in the left-hand navigation menu.

When everything looks good, click “Next Step”.

Sign & Submit

Agree to the terms and sign the document.

- Signer’s Capacity: Enter “Self“.

- Signature: Enter your first and last name.

- Date: Click “Today” to enter today’s date.

- Position: Select “Authorized Agent“.

Enter your phone number and email address.

Then click “File Online” to submit your filing and make your payment to the state.

Approval

Congratulations, you’ve successfully filed your Montana LLC Annual Report!

You should see a success screen letting you know that your Annual Report has been immediately approved.

Montana LLC Annual Report Reminders

As mentioned above, the state will send out email reminders every 2 weeks between January and April 15 until your Annual Report is filed.

That said, even if you don’t receive a reminder of any kind, you are still responsible for filing the Annual Report on time.

So we recommend putting a repeating reminder on your phone, computer, and/or calendar just in case.

Here’s how to create free Annual Report reminders with Google Calendar

Note: If you want help filing your paperwork, you can hire a company that offers Annual Report service. Check out our review of the best LLC services for our recommendations.

Montana Secretary of State Contact Info

If you have any questions, you can contact the Montana Secretary of State at 406-444-3665.

Their hours are Monday through Friday, from 8am to 5pm Mountain Time.

References

Montana Secretary of State: Requesting Authority

Montana Secretary of State: File Your Annual Report

Montana Secretary of State: Business Services Filing Fees

Montana Code Annotated: 35-8-208 – Annual report for Secretary of State

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.